A Honloulu Certified Distressed Property Expert is a real estate agent trained to help homeowners avoid foreclosure. A Certified Distressed Property Expert, or CDPE has specialized training with the complex issues confronting distressed home owners. Foreclosure avoidance options available to homeowners. Through comprehensive training and experience, CDPEs are able to provide solutions for homeowners facing hardships in today’s market, specifically short sales. Are you behind on your house payments? Are you facing Foreclosure, Pre-Foreclosure or Notices of Default from your lender? You may be surprised at the options available to you. You might not have to walk away from your home! Continue Reading about Honolulu Certified Distressed Property Expert

Blog

May 2023 Foreclosure Report

Hawaii Foreclosure Prevention

As Hawaii faces economic challenges, foreclosure prevention has become a priority. Learn your options for keeping your home. With a rise in unemployment rates and a slowdown in tourism, many people are struggling to make their mortgage payments. If you are one of the many homeowners in Hawaii who is concerned about foreclosure, it's important to know that there are resources available to help you. In this blog post, we will explore foreclosure prevention and different ways that you can help you stay in your Hawaii home. 1-Understand How to Prevent a Foreclosure Process in Hawaii Before we dive into the specific strategies for foreclosure prevention, it's important to understand how the Continue Reading about Hawaii Foreclosure Prevention

How Rising Honolulu Interest Rates are Affecting Distressed Homeowners

As Honolulu interest rates continue to climb, many distressed homeowners are feeling the financial strain. Higher interest rates mean higher borrowing costs, which can lead to difficulty in making mortgage payments and even foreclosure. In this blog post, we'll explore how rising interest rates are affecting distressed homeowners and what they can do to manage their finances. The Impact of Rising Honolulu Interest Rates on Distressed Homeowner For homeowners with adjustable-rate mortgages (ARMs), rising interest rates can lead to significant increases in their monthly payments. ARMs typically have lower initial interest rates that adjust over time based on market conditions. When interest Continue Reading about How Rising Honolulu Interest Rates are Affecting Distressed Homeowners

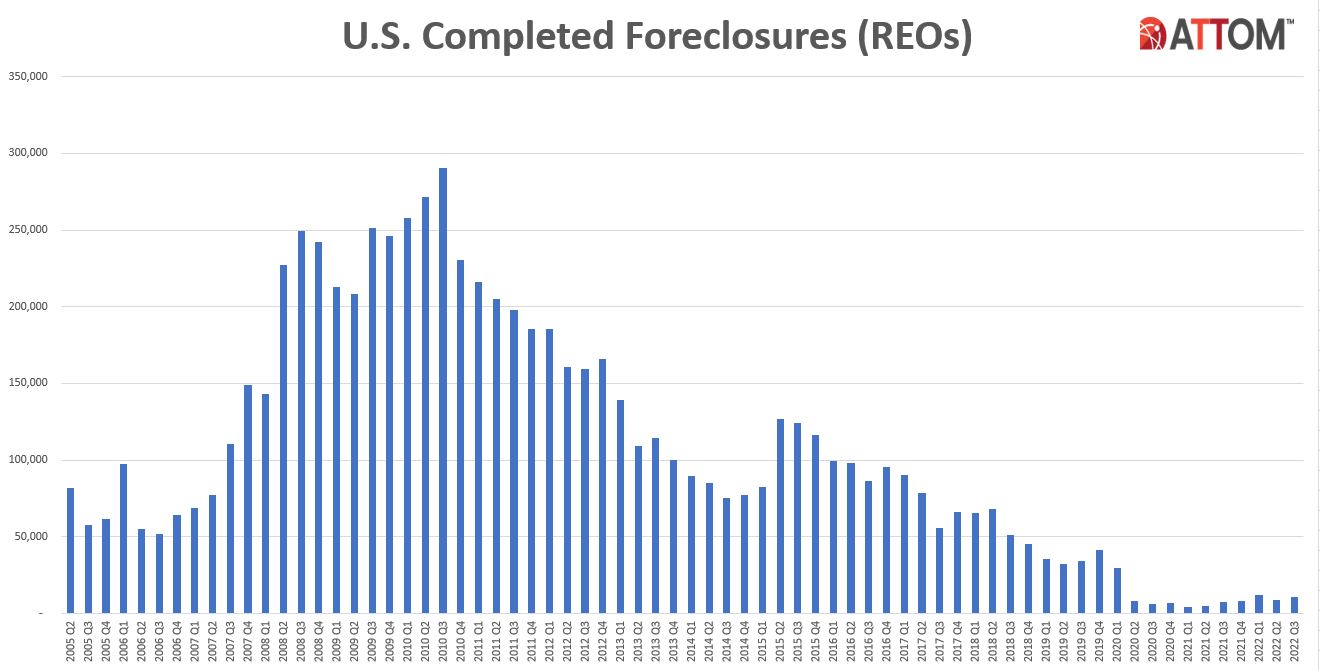

Foreclosure Activity Increases Nearing Pre-Pandemic Levels

Foreclosure starts close to pre-pandemic levels nationwide Lenders started the foreclosure process on 67,249 U.S. properties in Q3 2022, up 1 percent from the previous quarter and up 167 percent from a year ago — nearly reaching pre-pandemic levels. “Foreclosure starts, while rising since the end of the government’s foreclosure moratorium, still lag behind pre-pandemic levels,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “Foreclosure activity is reflecting other aspects of the economy, as unemployment rates continue to be historically low, and mortgage delinquency rates are lower than they were before the COVID-19 outbreak.” States that posted the Continue Reading about Foreclosure Activity Increases Nearing Pre-Pandemic Levels

Separate the Myth from the Reality

It used to be that if you were facing foreclosure, it was difficult to find information about what to do. Today, distressed homeowners have the exact opposite problem. There is information everywhere, but it can be almost impossible to tell the truth from the fiction. But there is one fact that you can take to the bank: You have options. As a Certified Distressed Property Expert® (or CDPE) located in I make it my mission to help you separate the myth from the reality about the options that are available to you. Understanding your options and acting can help relieve the burden of your mortgage. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: Continue Reading about Separate the Myth from the Reality

How much equity U.S. homeowners have lost since May

Homeowner equity peaked at $11.7 trillion collectively last May, after home prices jumped 45% since the start of the pandemic.In September, home prices fell on a month-to-month basis for the third month in a row.Since July, the median home price has dropped by $11,560. The historic run-up in home prices during the first two years of the pandemic gave homeowners record amounts of new home equity. Since May, however, about $1.5 trillion of that has vanished, according to Black Knight, a mortgage software and analytics company. The average borrower has lost $30,000 in equity. Homeowner equity peaked at $17.6 trillion collectively last May, after home prices jumped 45% since the start Continue Reading about How much equity U.S. homeowners have lost since May

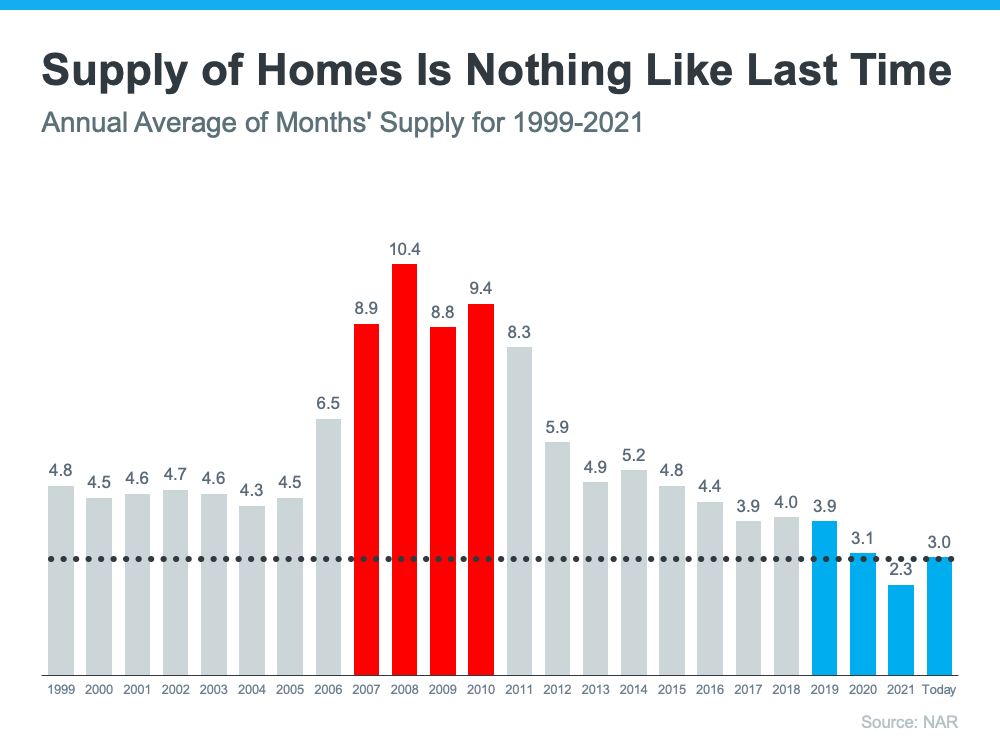

Hawaii Housing Bubble

Hawaii Housing Bubble The Hawaii housing bubble is on the way. With headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time. There’s a Shortage of Homes on the Market Today, Not a Surplus Inventory supply needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and Continue Reading about Hawaii Housing Bubble