As Hawaii faces economic challenges, foreclosure prevention has become a priority. Learn your options for keeping your home. With a rise in unemployment rates and a slowdown in tourism, many people are struggling to make their mortgage payments. If you are one of the many homeowners in Hawaii who is concerned about foreclosure, it's important to know that there are resources available to help you. In this blog post, we will explore foreclosure prevention and different ways that you can help you stay in your Hawaii home. 1-Understand How to Prevent a Foreclosure Process in Hawaii Before we dive into the specific strategies for foreclosure prevention, it's important to understand how the Continue Reading about Hawaii Foreclosure Prevention

Uncategorized

How Rising Honolulu Interest Rates are Affecting Distressed Homeowners

As Honolulu interest rates continue to climb, many distressed homeowners are feeling the financial strain. Higher interest rates mean higher borrowing costs, which can lead to difficulty in making mortgage payments and even foreclosure. In this blog post, we'll explore how rising interest rates are affecting distressed homeowners and what they can do to manage their finances. The Impact of Rising Honolulu Interest Rates on Distressed Homeowner For homeowners with adjustable-rate mortgages (ARMs), rising interest rates can lead to significant increases in their monthly payments. ARMs typically have lower initial interest rates that adjust over time based on market conditions. When interest Continue Reading about How Rising Honolulu Interest Rates are Affecting Distressed Homeowners

Hawaii Housing Bubble

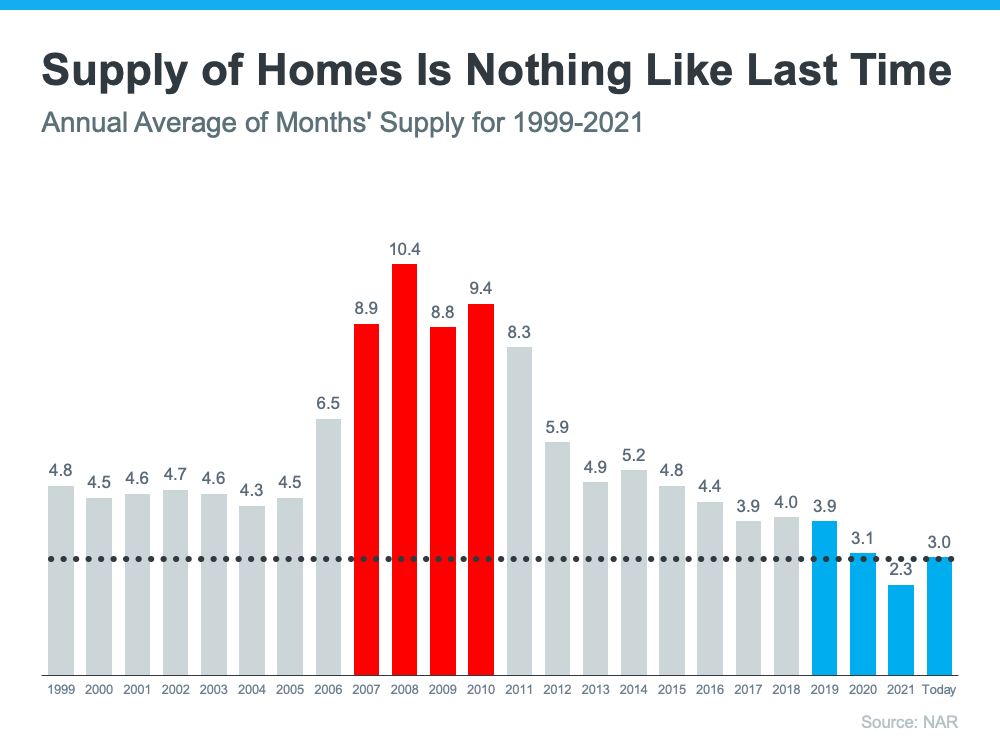

Hawaii Housing Bubble The Hawaii housing bubble is on the way. With headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time. There’s a Shortage of Homes on the Market Today, Not a Surplus Inventory supply needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and Continue Reading about Hawaii Housing Bubble

US Home Values Fell in August

America’s housing market continued to cool this summer as high interest rates keep buyers at bay. But there are some markets that are still growing amidst the doom and gloom. Home values suffered a precipitous drop from July to August, falling by 0.3%, according to Zillow’s housing most recent market report. It’s the largest month-to-month fall since 2011. Experts have already declared a housing recession is upon us. And more bad news came Wednesday when the Federal Reserve announced another supersized rate hike, throwing even colder water on the housing market. A 30-year-mortgage rate is now above 6%, a chilling perspective for anyone hoping to buy or sell. According to the Fed Fed Chair Continue Reading about US Home Values Fell in August